Industry Overview: Chocolate Confectionery In Hong Kong SAR, China - Market Dynamics, Trends, Competitors [2024]

Market Dynamics

Hong Kong’s chocolate confectionery market features around 80 brands. By segment, milk chocolate confectionery is the largest, followed by dark chocolate. The better-for-you segment remains small, making up only a single-digit percentage of the overall market. Packaging preferences indicate bars and boxes are most popular. Store brands have a negligible presence.

Almond flavors are among the most popular in Hong Kong, suggestive of a preference for nutty tastes that align with local culinary traditions, over overly sweet flavors.

Recent Trends

The majority of recent product launches have focused on introducing new and innovative flavors. Notable launches include ROYCE' Kyoto Choco Bar Toffee & Yuzu and ROYCE' Nama Roasted Sweet Potato.

Trade Data Insights

Overall

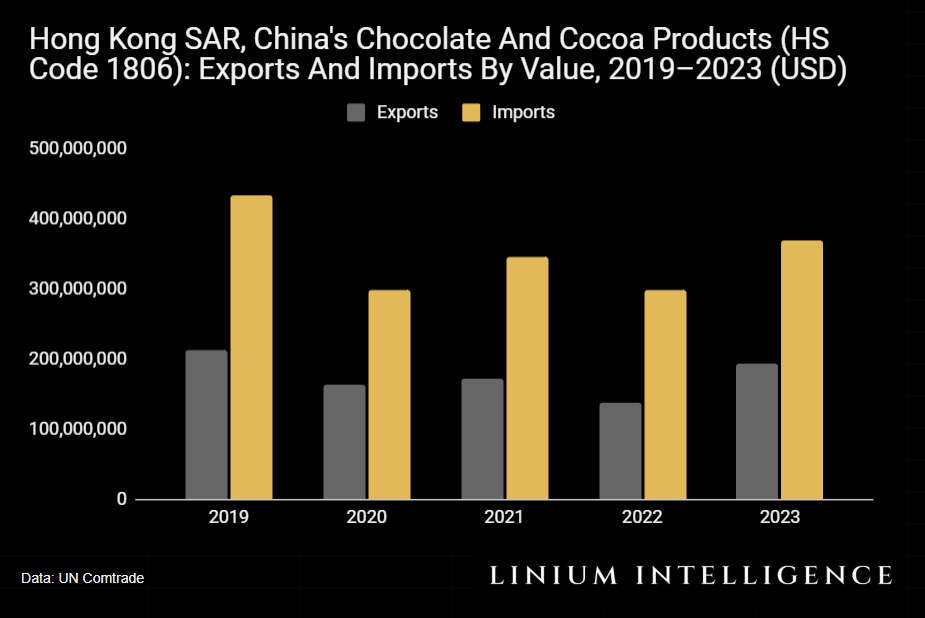

Hong Kong SAR, China is a net importer of chocolate confectionery products. Imports of chocolate and cocoa products (HS code 1806) amounted to nearly USD 370 million in 2023, nearly double the country’s chocolate confectionery exports of USD 194 million the same year.

Imports have declined at a CAGR of -4% between 2019 and 2023, while exports declined -2% CAGR the same period.

Exports

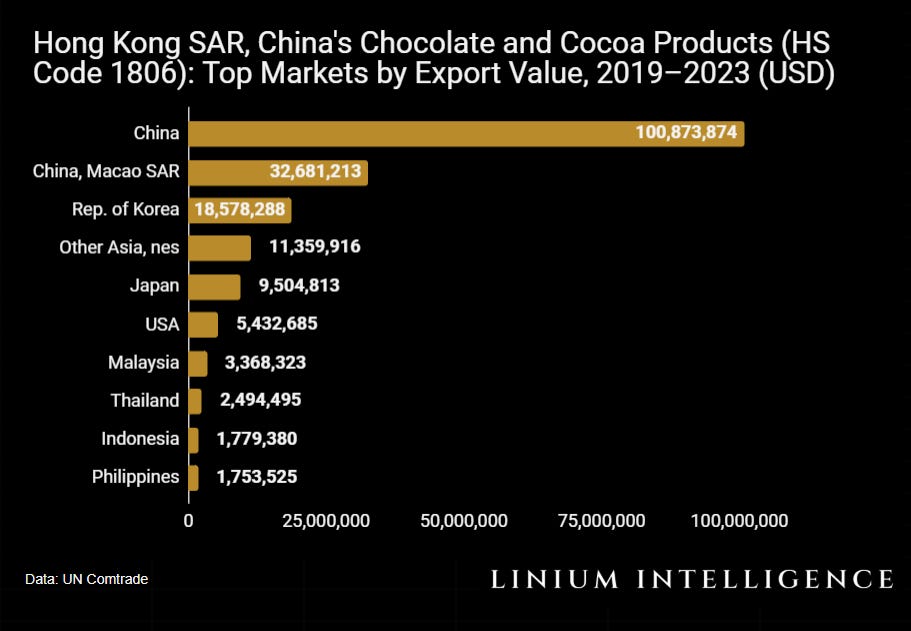

In 2023, Mainland China was Hong Kong’s largest export market for chocolate confectionery, accounting for approximately USD 100 million, or 52% of total exports. Macau SAR, China ranked second with USD 32 million, representing 17% of the market. South Korea followed in third place, with USD 18 million, or 10% of exports. Japan accounted for 5%, or around USD 9.5 million. Other notable trading partners included Malaysia, Thailand, Indonesia, the Philippines, Singapore, Australia, and Vietnam, each contributing a small single-digit percentage to Hong Kong's chocolate confectionery exports.

Imports

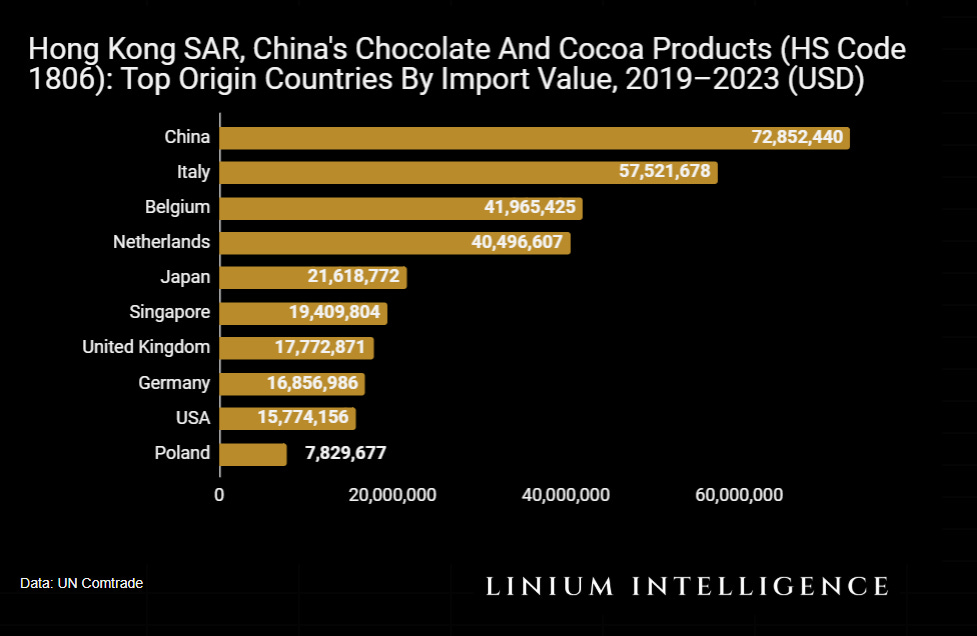

As of 2023, Mainland China was the leading origin country for Hong Kong’s chocolate confectionery imports, accounting for USD 73 million, or 20% of total imports. Italy ranked second with USD 57 million, representing 16%, followed by Belgium and the Netherlands, each contributing over USD 40 million, or 11%. Japan accounted for USD 21 million, or 6%, while Singapore, the United Kingdom, and Germany each made up 5%. The United States contributed USD 15.7 million, or around 4%. Other notable origin countries included Poland, France, Australia, Malaysia, Bulgaria, Turkey, and Thailand, each contributing single-digit percentages to Hong Kong’s chocolate confectionery imports.

Key Distribution Channels

The primary distribution channels are grocery retailers and direct-to-consumer (DTC) channels. Major supermarket chains include Wellcome, ParknShop, and City Super. A small fraction of brands operate online and offline DTC channels.

Competitive Landscape

Lindt and Godiva are among the biggest brands in the market and are leading players in both the dark chocolate segment and bar format. In the milk chocolate category, Kinder, M&Ms and Meiji are major players. Kinder is also a leading brand in the white chocolate segment. Godiva is a major player in the vegan/plant-based and box format segments, while Sugar Free D’lite is a strong force in the sugar-free category. M&Ms and KitKat top the bag format, and Food Nation holds a strong position in the organic segment.

Mass market brands include Maltesers and KitKat while premium brands include Venchi and Charbonnel et Walker.

Lindt, Godiva and Kinder are major brands in the grocery channel, while Godiva, La Maison du Chocolat and Venchi are notable players with online and offline DTC operations.