Industry Overview: Chocolate Confectionery In Malaysia - Market Dynamics, Trends, Competitors [2024]

Market Dynamics

Malaysia’s chocolate confectionery market consists of around 70 brands, with milk chocolate confectionery being the largest segment, followed by dark chocolate. The better-for-you segment remains small, accounting for only a single-digit percentage of the market.

Bags are the most common packaging format. Store brand share is virtually nonexistent.

Almond is a popular flavor, indicating a preference for nutty tastes over sweet options.

Recent Trends

Single origin flavors are in vogue in Malaysia. Notable brand launches during the year include Kitkat Dark Borneo, made with beans from Sabah and Sarawak, and Benns Ethicoa’s 68% Kota Marudu dark chocolate.

Products inspired by the worldwide Dubai chocolate bar sensation have also made waves in Malaysia. Local chocolatiers Cocoraw, and Soulgood rolled out their versions of the Dubai-inspired bar during the year.

Trade Data Insights

Overall

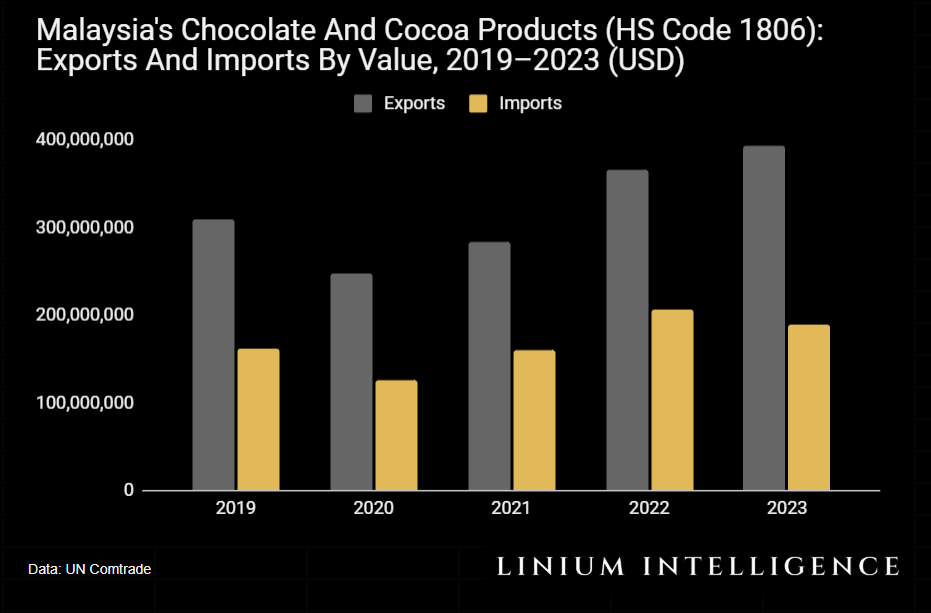

Malaysia is a net exporter of chocolate confectionery products. Exports of chocolate and cocoa products (HS code 1806) amounted to nearly USD 394 million in 2023, double the country’s chocolate confectionery imports of USD 189 million the same year.

Exports have grown at a CAGR of 6% between 2019 and 2023, while imports have grown 4% CAGR the same period.

Exports

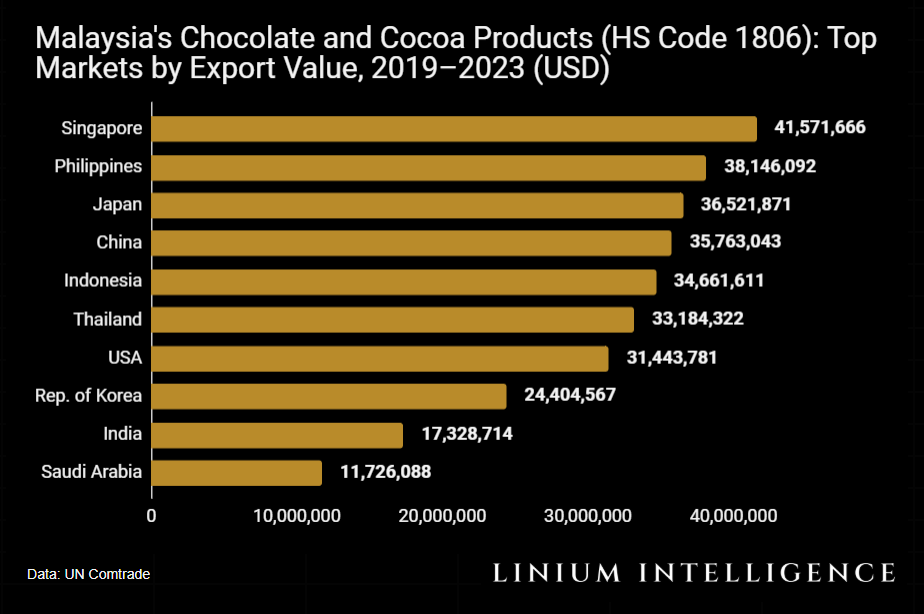

In 2023, Singapore was Malaysia's largest chocolate confectionery export market, accounting for USD 41 million, or 11% of total exports. The Philippines closely followed in second place, with USD 38 million, representing 10% of Malaysia's chocolate confectionery exports. Japan, China, and Indonesia each accounted for over USD 34 million, or 9% each. Thailand and the United States were next, contributing over USD 30 million, or 8%, followed by South Korea with USD 24 million, or 6%, and India with USD 17 million, or 4%. Other important trading partners included Saudi Arabia which accounted for over USD 11 million, or 3%.

Imports

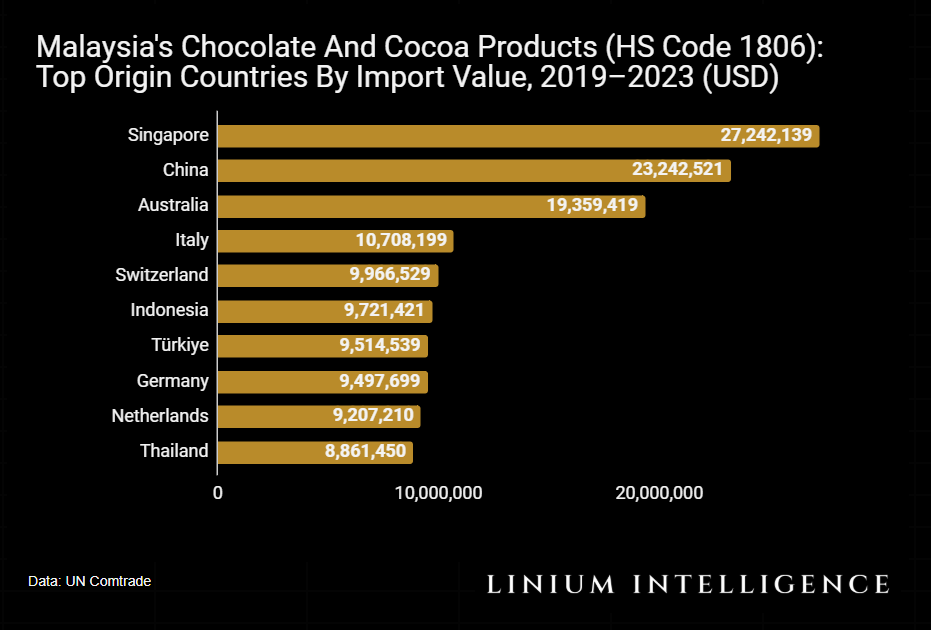

In 2023, Singapore was Malaysia's largest origin country for chocolate confectionery imports, accounting for USD 27 million, or 14% of total imports. China followed with USD 23 million, or 12%, and Australia contributed USD 19 million, or 10%. Italy accounted for USD 10.7 million, or 6%, while Switzerland, Indonesia, Turkey, Germany, the Netherlands, and Thailand each contributed around 5%. India and the United States each accounted for 4%. Other notable origin countries included South Africa, Belgium, Poland, and Sweden, each contributing 2%.

Key Distribution Channels

Major distribution channels for chocolate confectionery in Malaysia include grocery retailers, convenience stores, specialty confectionery stores, and brand-owned online and offline direct-to-consumer (DTC) channels.

Notable grocery retailers include Cold Storage, Jaya Grocer, Giant, AEON, and Mydin. Notable convenience stores include 7-Eleven, 99 Speedmart, and KK mart. A handful brands operate online and offline DTC channels.

Competitive Landscape

Mondelez-owned Cadbury is Malaysia’s top brand. By segment, Cadbury, KitKat, and Snickers are major brands in the milk chocolate segment, while Lindt, Beryl’s, and Whittaker’s are notable players in the dark chocolate category. Hershey’s holds a strong position in the white chocolate segment.

Godiva has a prominent presence in the vegan/plant-based segment, and Royal de Dolton is a dominant player in the sugar-free category.

In terms of packaging formats, Cadbury, Whittaker’s, and Lindt are major players in the bar format, while Beryl’s and Ferrero are major brands in the box format. M&Ms and Cadbury hold strong positions in the bag format.

Mass market brands include Crispy, and Apollo while premium brands include Lindt, and ROYCE’.

In terms of distribution, Cadbury, Ferrero, and Hershey’s are major grocery channel brands, while Beryl’s, ROYCE’ and Godiva are brands with significant online and offline DTC operations in Malaysia.