Industry Overview: Chocolate Confectionery In Singapore - Market Dynamics, Trends, Competitors [2024]

Market Dynamics

The chocolate confectionery market in Singapore is diverse, with at least 90 brands competing for consumer attention. Milk chocolate confectionery is the dominant category, followed by dark chocolate confectionery, while the better-for-you segment remains small. Bars are the most popular packaging format and there is negligible presence of store brands in the market.

Almond is among the most favored flavors among consumers.

Recent Trends

Product innovation remains a key driver in the Singaporean chocolate market, with many brands focusing on new flavor profiles inspired by local culinary delights. Notable launches during the year include Mr. Bucket Chocolaterie’s Spicy Salted Egg Cereal bon bon, and CHOCOELF’s chocolate bars inspired by Singapore flavors namely "Fluffy Chicken Floss", "Umami Soy Brew", and "Black Cold Brew".

Dark chocolate also continues to be in vogue. Notable launches include Venchi’s nine new 60% and higher dark chocolate flavors, and KitKat’s Dark Borneo 52% to name a few.

Trade Data Insights

Overall

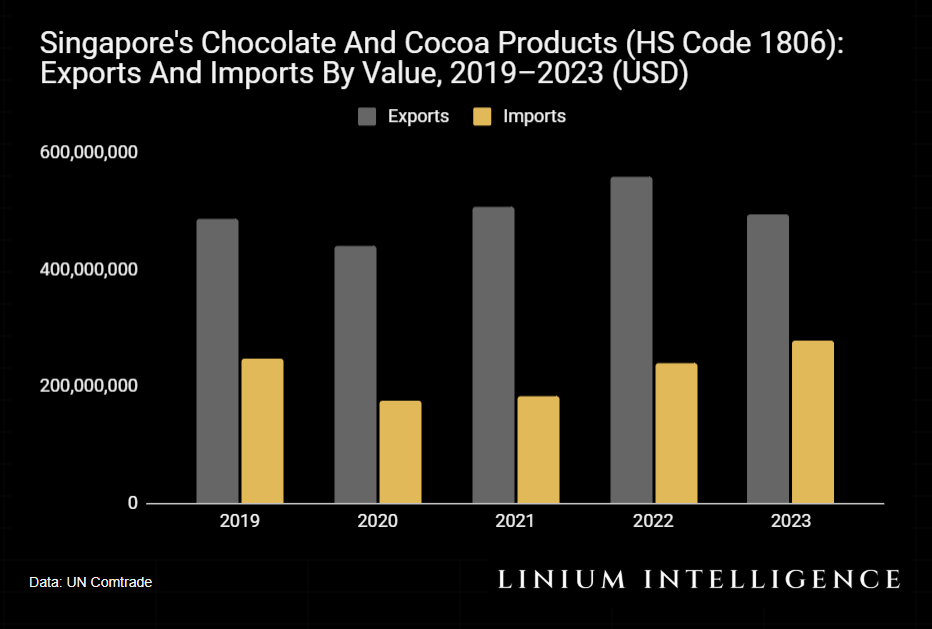

Singapore is a net exporter of chocolate confectionery products. Exports of chocolate and cocoa products (HS code 1806) amounted to USD 495 million in 2023, nearly double the country’s chocolate confectionery imports of USD 279 million the same year.

Exports have barely grown during the period 2019 to 2023, while imports have grownat a 3% CAGR the same period.

Exports

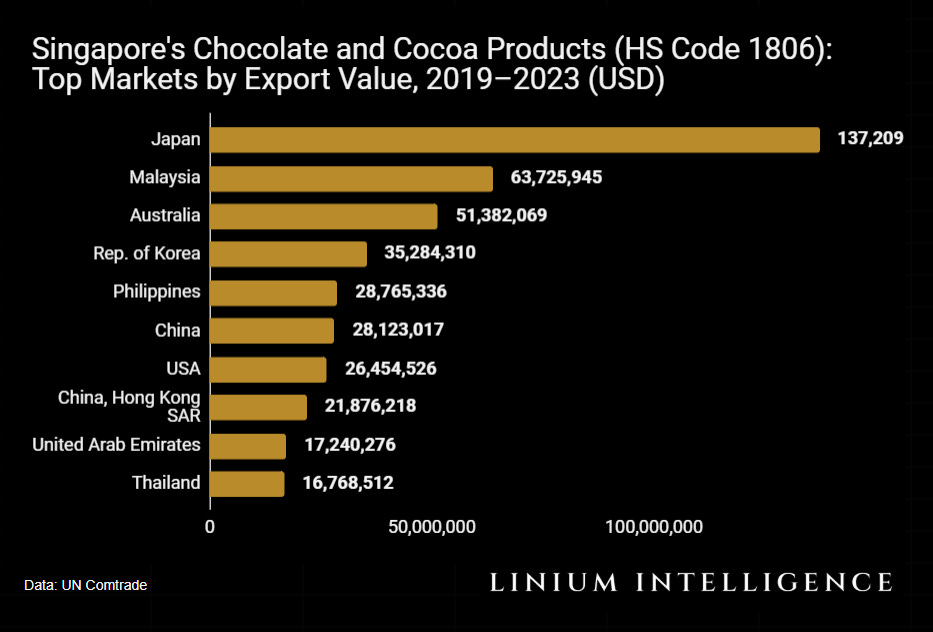

As of 2023, Japan is Singapore’s largest export market for chocolate confectionery, accounting for USD 137 million, or 28% of Singapore's total chocolate confectionery exports. Malaysia ranks second with nearly USD 64 million, or 13%. Australia follows closely with USD 51 million, or 10%, followed by South Korea at USD 35 million, or 7%.

The Philippines and China each account for approximately USD 28 million, or 6%, while the United States contributes USD 26 million, or 5%. Hong Kong SAR, China, accounts for nearly USD 22 million, or 4% of Singapore’s chocolate confectionery exports. Other notable trading partners include the United Arab Emirates, Thailand, and Indonesia, which each represent a single-digit percentage of Singapore’s chocolate confectionery exports.

Imports

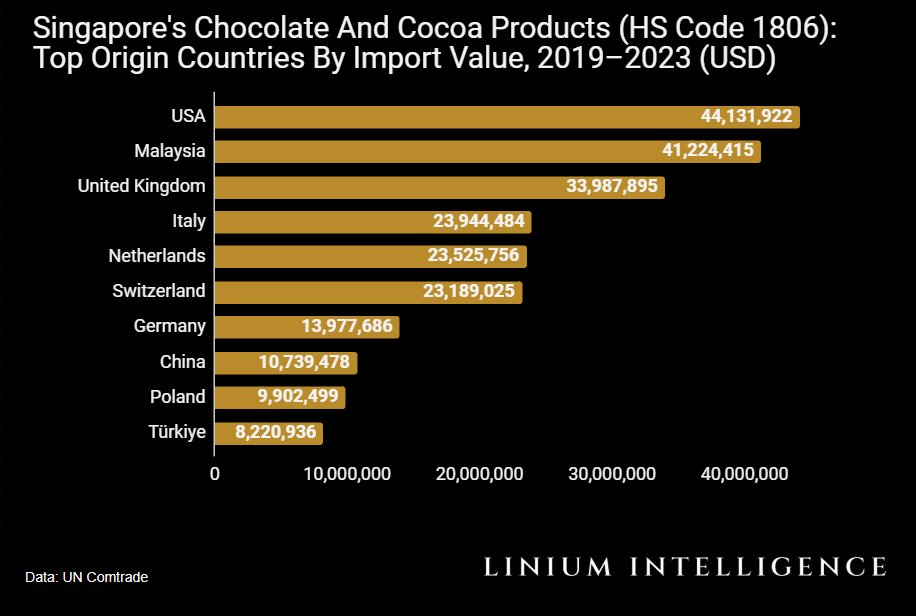

As of 2023, the United States is Singapore’s largest origin country for chocolate imports, accounting for USD 44 million, or 16% of total chocolate imports. Malaysia follows closely with USD 41 million, or 15%, while the United Kingdom contributes USD 34 million, or 12%, and Italy accounts for USD 24 million, or 9%. The Netherlands and Switzerland each represent around USD 23 million, or 8%, followed by Germany with USD 14 million, or 5%, and China and Poland, each contributing approximately USD 10 million, or 4%. Other significant origin countries include Turkey, Belgium, France, Australia, Sweden, Japan, and Indonesia.

Key Distribution Channels

Major distribution channels for chocolate confectionery in Singapore include grocery retailers, and brand-owned online and offline direct-to-consumer (DTC) channels.

Notable grocery retailers include NTUC, Cold Storage, and Giant. A handful brands operate online and offline DTC channels.

Competitive Landscape

Cadbury is Singapore's biggest brand by market share according to Linium Intelligence data. By segment, major brands in the milk chocolate confectionery segment include Cadbury, and KitKat while Lindt is among the top brands in the dark chocolate segment and Hershey’s has a strong position in white chocolate.

Other notable competitors include Ritter Sport in the vegan/plant-based category, Sugarless Confectionery in the sugar-free sector, and Loving Earth in the organic space.

Cadbury and Ritter Sport are strong in the bar format, Ferrero and Kinder are major brands in the the box format, while brands like KitKat and Cadbury excel in bags.

Mass market brands include Cadbury and Snickers, while premium brands include Godiva, and Vietnamese artisan chocolate brand Marou.

By channel, Cadbury and KitKat are major grocery brands while Awfully Chocolate and Godiva are among brands with strong online and offline DTC operations.